Funiculì, Funiculà

The Value Fund is down -9.2% year-to-date (YTD), more than half of that decline coming in the month of June. The bear market has officially arrived with the S&P500 off to its worst start in over 50 years. People holding more speculative assets like cryptocurrencies, have likely suffered a permanent impairment of their capital.

Even ‘ultra-safe’ treasuries took a beating and are down -11% YTD. When you invest in 10-year government bonds in exchange for a measly 2% pre-inflation return, you are asking for trouble. We have long warned about frothy markets and irrational asset classes like non-fungible tokens (NFTs). We have also called out companies like Shopify (SHOP) whose valuations were simply insane.

As the Oracle of Omaha so vividly put it, you only know who has been swimming naked when the tide goes out. The tide is ebbing.

(1) Index returns are for the total return indexes which include dividends and are measured in Canadian dollars, the Value Fund’s reporting currency. Changes in bond values are based on iShares exchange-traded funds (Source: Factset, Wall Street Journal).

The selloff was overdue. The US Federal Reserve and other central banks kept interest rates too low for far too long. These huge injections of liquidity led to the inevitable result. Asset price inflation, real-world inflation, TINA (there is no alternative) and FOMO (fear of missing out). Investors were encouraged by easy money to take things too far and greed overtook prudence. These factors are now working in reverse.

Against this backdrop, we have been defensively positioned. We constructed our house of bricks long before the market storm arrived. As a result, it has withstood much of the broader market damage.

Now, before we get too carried away patting ourselves on the back, the Value Fund is still down for the year. We have much work to do between now and year end to keep our streak of 10+ consecutive years of positive returns alive. But the current market turmoil and growing fears of a recession are a welcome development for long-term value investors like GreensKeeper. Here’s why:

- Many of the companies that we own are market leaders with healthy balance sheets. During times of stress, they typically take market share from weaker competitors who may not even make it. Most have pricing power and the ability to pass on increasing costs to their customers. A few of our holdings even benefit from inflation (e.g., Visa (V), American Express (AXP)).

- Our portfolio companies are also cannibals — they use their prodigious cash generation to habitually repurchase their own shares in the open market. Lower prices means they get more bang for their buck.

- The same principle applies to GreensKeeper. In a declining market, we are able to acquire additional earnings for each incremental dollar invested. Accordingly, lower stock prices reduce the riskiness of our investments. Please read that sentence again. It is contrary to the way that most people think about and interact with the stock market.

- While the broader markets are down 20-30%, certain stocks that we track are off significantly more and starting to get interesting.

- As stocks and asset prices decline, levered investors receive margin calls and are forced to sell. Even unlevered investors become frightened at the prospect of further price declines and decide to sell and wait until things ‘stabilize’. As Baron Rothschild said, the best time to buy is when there is blood in the streets.

Put simply, this growing fear is our friend. It puts market participants into a short-term mindset and creates mispricings that we can take advantage of. All that is required is discipline, the courage to act and never losing sight of the long-term. If you struggle with this concept, perhaps the following illustration will help. (2)

Fear sells which is why you will find charts like these reproduced in newspapers, TV and online every time a new bear market arrives. It looks scary, doesn’t it? That’s because it triggers the primitive flight response that is hard wired into our genes.

Could the bear market of 2022 go lower still? Sure. As we have written many times, we have no idea what markets will do over short periods of time and neither does anyone else. Timing the bottom is impossible. In our opinion, those that try to do so are playing the wrong game.

(2) Series show the percentage change in the S&P500 index from peak to trough for each decline, except for 2022+ which is to May 11. Sources: Yahoo Finance; Reddit – https://tinyurl.com/2p8hp3zf

When pundits describe the stock market as a roller coaster, the stomach-churning plunges on the prior chart are what they are referring to. Unfortunately, this metaphor is not only deeply flawed, but also insidious as it conditions investors to learn the wrong lessons.

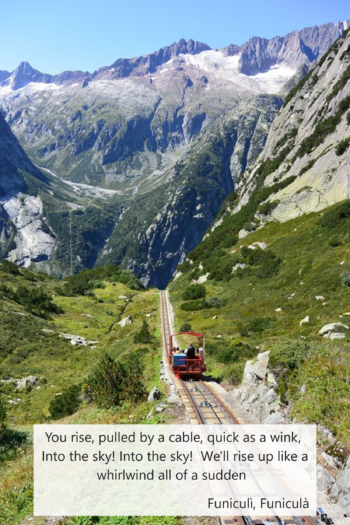

A roller coaster ride may be fear inducing, but it leaves you back exactly where you started. That isn’t true for stock market investors with a long-term time horizon. With the proper longer-term perspective (see chart below) the stock market is better described as a cable car or funicular, not a roller coaster. Yes, one may experience an unpleasant jolt from time to time. But those seemingly massive declines on the prior chart look piddling—and much less scary—when put into their proper long-term context.

We believe that the proper lesson to take away from the current market selloff is the following. It will eventually end. If you can keep your cool and don’t jump off (by staying invested), the stock market funicular will eventually carry you to much higher ground. Sometimes much quicker than you expect.

You rise, pulled by a cable, quick as a wink, Into the sky! Into the sky!

We’ll rise up like a whirlwind all of a sudden

Funiculì, Funiculà

Source: GreensKeeper, Capital IQ.

Portfolio Update

This is the perfect time to repeat what we wrote a year ago in Scorecard #34:

“Trying to predict and successfully time when the next storm will arrive is not a substitute for sturdy construction. Financial storms tend to arrive with little warning. The key to resilience is to know that they will inevitably come and to prepare in advance.”

Our portfolio was properly positioned for the current market downturn. As a result, there were no major changes to the portfolio during the first half of the year and our top-ten holdings were virtually unchanged.

Vertex Pharmaceuticals (VRTX) joined the top ten due to its +28.3% YTD performance. Two of our portfolio companies changed their names: Facebook is now known as Meta Platforms (META) and Anthem recently renamed itself Elevance Health (ELV).

We added to our positions in Fiserv (FISV), Meta Platforms (META) and trimmed our holdings of American Express (AXP). Otherwise, there is nothing new to report. Our current thinking on VRTX and META can be found in Scorecard #37 and a full writeup of our investment thesis for FISV can be found here.

The Value Fund finished Q2 with a 13% net cash position and we are actively searching for attractive places to put it to work.

Final Thoughts

Profitability, cash flow and valuation are once again in vogue. In other words, sanity is returning to the markets. Our research team is furiously looking at hundreds of companies, updating our models and searching for value.

Valuations have come down and attractive opportunities are starting to present themselves. With cash constantly streaming into the Value Fund from new and existing clients, we are selectively putting our money to work. This is a great time to be a value investor.

********

Each of our full-time employees has their entire investment portfolio invested at GreensKeeper. In my case, it represents over 70% of my household’s net worth. We invest in the same stocks as our clients and our approach is one of partnership.

If our partnership approach resonates with you, or someone you know could use some help with their investments, please give me a call.

Michael P. McCloskey

President, Founder &

Chief Investment Officer