Get a Grip

The Value Fund is down -9.5% year-to-date (YTD) with the US dollar providing some welcome protection from the broad market selloff.

Through Q3 we are ahead of the major indices which are all deep into the red: DJIA -12.3%, S&P500 -16.8%, Nasdaq -25.7% and S&P/TSX -11.1%.(1) Investors holding more speculative stocks have suffered even steeper losses.

In the eleven years we have been publishing this quarterly newsletter, we have not written much about the economy or macroeconomics. Like any complex adaptive system, we believe that it is extremely difficult to predict the modern-day economy’s future path with much accuracy. Economics has been dubbed the dismal science for good reason. But the macro seems to be the only thing driving the markets these days and so we will use this quarterly update to share our perspective.

(1) Index returns are for the total return indexes which include dividends and are measured in Canadian dollars, the Value Fund’s reporting currency.

The Dismal Science

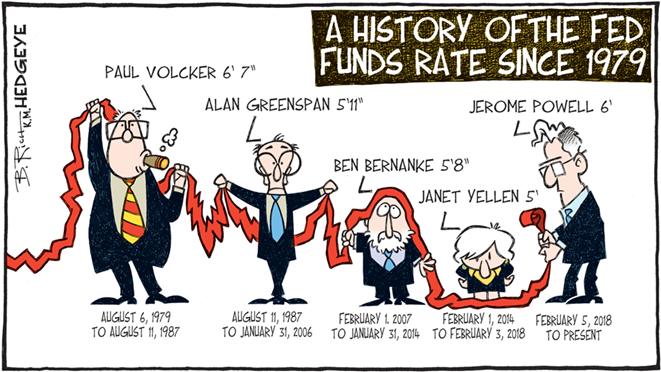

Geopolitical tensions between Iran, Russia and the West are very high. OPEC production cuts and an energy crisis are driving up commodity prices and inflation is running hot. Obviously, I am referring to the economic environment of 1979. The lessons of that era are worth revisiting and provide some helpful hints for navigating the current environment.

Inflation is a dirty word for good reason. It is an insidious tax on consumers and makes it very difficult for businesses to plan or make long-term investments. With unemployment near record lows and inflation far too high, the US Federal Reserve (the “Fed”), is focused squarely on getting inflation back in check.

The modern Fed learned how to stomp out inflation from the example set by revered former Fed Chairman Paul Volcker during that earlier era. Tighten the money supply, raise interest rates, and keep raising them until everyone believes that you are serious. Ignore the inevitable criticism and accept the fact that everyone will hate you. The Fed was structured independently from the federal government for exactly this reason. Their job is to do the right thing, not the popular thing.

Once the Fed’s credibility is restored and sufficient time passes, inflation will subside, albeit at the expense of the economy and lofty asset prices including equities. We find it mildly amusing to watch hysterical market pundits criticizing the Fed’s recent tightening cycle due to its detrimental impact on the economy and the markets. The Fed needs the economy to worsen. That’s the whole point!

Higher interest rates are the Fed’s only lever to get inflation back in check. The Fed is simply doing its job in accordance with its Congressional mandate of price stability and maximum sustainable employment. The stock market is finally starting to believe that the Fed is serious about lowering inflation. So how should we position our investments in the current market environment?

Some Historical Perspective

We believe that four decades of declining interest rates and moderate inflation has made everyone soft. For as long as most of us can remember, consumers, companies and governments have been spoiled by a combination of a near continuously growing economy, low inflation, and record-low interest rates. Unfortunately, there are no free lunches—eventually the bill comes due.

The first major post-Volcker-era shock came in 2008 via the US housing crash and the Great Recession. Loose monetary policy inflated a housing bubble in the United States. Its ultimate bursting almost took down the entire global financial system. Central banks reacted by injecting massive liquidity, lowering interest rates, and experimenting with quantitative easing.(2)

(2) For those interested in the history of the US Federal Reserve and its inner workings, we recommend Bernanke, Benjamin. 21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19. (New York: W.W. Norton & Co., 2022). A link to that book and other recommended readings can be found on our website’s bookshelf.

Source: Bob Rich, Hedgeye.

Fortunately, we survived that close call and for the next decade, ultra-low interest rates helped the jobs market and the economy recover, ultimately leading to the longest bull market in US history (2009-2020). The next big shock came in 2020 with the arrival of the coronavirus pandemic. The Fed’s response was once again loose monetary policy aided by a large helping of fiscal stimulus financed via rising government debt. Markets and economies quickly rebounded. Only this time, worrying signs of inflation started to emerge.

Conditioned by decades of stable prices, the Fed deemed rising inflation to be “transitory”, but it turned out to be anything but. In addition, keeping interest rates near zero encouraged risk taking and outright recklessness (crypto assets, NFTs and meme stocks). In Scorecard #30 (Q2 2020) we warned about the frothiness of the markets and advised caution.

With the benefit of hindsight, the Federal Reserve now knows that it made a major policy mistake by waiting too long to raise rates. It is now taking corrective action. US mortgage rates are approaching 7% and properly prices, which are highly sensitive to interest rates are beginning to soften. Market pundits like Jeremy Siegel and progressive politicians like Elizabeth Warren are screaming bloody murder at the Powell Fed. Get a grip.

All that a central bank can do is to use its best judgment to add stimulus when needed and take it away when it isn’t. The latter action is never fun. But if a central bank avoids inflicting pain when warranted, we ultimately end up with the disaster that is modern day Turkey and its 83% inflation rate. Politicians cannot wish away reality through magical thinking.

I can still remember my parents taking out a mortgage circa 1980 when inflation was running 13% and mortgage rates were in the mid teens. The current 5-year mortgage rate in Canada stands at 5.5%. We can handle this.

The chart below illustrates that interest rates are still very low by historical standards. That doesn’t make the recent increases benign. But their impact should be manageable in most cases.

Source: Federal Reserve Bank of St. Louis Economic Data (FRED).

We reckon that a big part of what gives life meaning is struggle. If an entire generation of borrowers were able handle the high interest rates and runaway inflation of the late 1970s, surely, most of the modern economy can manage through interest rates in the mid-single digits.

Navigating the Market

The stock market has reacted badly to the Fed’s current policy tightening cycle. Higher interest rates will slow the economy and lower corporate profits. A recession is certainly possible. In addition, money is flowing out of equities as fixed income rates become more attractive as an alternative. The increase in the risk-free rate along with these other factors mean that lower market multiples and equity valuations are a logical response.

However, just as things tend to overshoot on the upside during market bubbles, mass psychology also leads to overshooting on the downside. Our take is that this is a time to be more aggressive, but also discerning. Always discerning. Overleveraged companies and poor-quality businesses may not survive the current shocks they are facing and should be avoided.

We also suspect that the investment environment going forward is likely to be more difficult than the easy money days of the past. So what? As Charlie Munger likes to say, “[Investing] is not supposed to be easy. Anyone who finds it easy is stupid.”

At GreensKeeper, we are managing through the current market challenges and searching for value. But the recent market gyrations also remind us of the importance of four of our key investment principles that we wish to reinforce for the benefit of all our clients.

The Economy is Not the Stock Market

One mistake that investors often make is to assume that the stock market will decline when the economy is in recession, or one is forecasted. Our own work suggests that the stock market shows very little correlation with economic growth. Others have come to a similar conclusion:

“The trouble with picking stock markets on the basis of expectations of GDP growth is not that GDP growth is hard to predict (although it is harder than many people assume), it’s that even if you could predict it with perfect accuracy, it wouldn’t do you any good picking stock markets.”

Ben Inker, Grantham, Mayo, & van Otterloo (GMO) (3)

Could we be headed for a recession in the near term? Sure. But in our opinion, that’s the wrong question to be focused on. Even if one can answer it right, predicting the market’s reaction is equally difficult.

In addition, the value of most companies (stocks) tends to change slowly as it is based on the lifetime of future cash flows it will provide to its owners (shareholders), discounted at an appropriate rate. Over 95% of the value of most companies has nothing to do with their earnings this year. Will S&P Global Inc.’s (SPGI) earnings be lower in a rising interest rate environment? Certainly. But a few years of low earnings barely changes our estimate of the company’s intrinsic value. The value of that business, and most other businesses, is in the tail.

Don’t believe us that short-term market movements are impossible to predict? Here’s a recent example. On the day that we wrote this letter, the pre-market release of the US inflation report disappointed, and the market dropped by -2.4% at the open. By the close, the market finished up +2.6% with no major market news responsible for the reversal. Does anyone honestly believe that the collective intrinsic value of the listed companies changed by over 5% within a matter of hours?

Want more proof that markets can do very strange things over relatively short periods of time? In a typical year, the difference between the high and low price of many widely followed stocks such as Apple (APPL) can be 50%. This is noise, not signal.

(3) GMO White Paper: Reports of the Death of Equities Have Been Greatly Exaggerated: Explaining Equity Returns. Ben Inker, August 2012.

We believe in focusing on the things that we can control. Macroeconomic factors are only important insofar as they impact the future profitability of any company and hence its intrinsic value. We update our valuations accordingly and then compare them with the prices being offered by Mr. Market (which have become more attractive lately).

We do not spend any of our time trying to figure out when the market will bottom. It can’t be done. However, we can react when a bargain is on offer, knowing that we will inevitably never time our purchase perfectly by buying at the bottom tick. Instead, we focus on fundamentals and valuations, not predicting market movements.

Think in Probabilities

Ever wonder why so many investment professionals advise their clients to stay invested? Because it flows naturally from the following market facts.

Since launching the Value Fund in 2011, the fund and the market have both been up about 69% of the time (measured monthly). Longer-term studies of the S&P500 peg that number ever higher.(4) Over the past century, the US stock market has provided superior returns to all other major asset classes.

Fortunes have been made by casinos via games of chance that give the house a slight edge of just a few percent over their customers. Over long periods of time, the house is guaranteed to come out ahead despite some fluctuations in their daily profits and losses.

The stock market is a game that provides its players with even better odds. By purchasing above-average companies when they are undervalued, we try and stack the odds even more in our favour. When investors are scared, stock prices tend to be attractive and stocks less risky. In other words, it is usually a good time to put money to work. No different than a card counter at a blackjack table raising her bets when the count is in her favour.

Equities are a winning game. If you have a sufficient time horizon and can handle the volatility, the secret is to just keep playing. Investors who think that they can consistently predict when to exit and then reenter the equity markets are delusional. Market timers deliberately forego playing this wonderful game. Stay invested.

The Importance of Resilience

Strange and unpredictable things happen from time to time. Russia invades the Ukraine. A global pandemic appears out of nowhere. Interest rates and energy prices spike as inflation suddenly appears. That’s why investing in quality companies matters. That’s why investing in undervalued companies matters. Investors need multiple margins of safety to deal with life’s unexpected twists and turns.

(4) “For almost a century, despite pandemics, recessions, inflation, deflation and wars, stocks have been on the rise 78% of the time. Many investors, however, consistently miss out on the market’s overall gains because they try to time getting in and out, missing the big days along the way.” Source: Tsai Capital and Ned Davis Research.

Companies that employed excessive financial leverage to maximize profits during the good times, are now facing a reckoning as interest rates reset. Some will not make it. As American race car driver Rick Mears so aptly put it, “to finish first, you must first finish”.

Other former market darlings were growing very fast, and for years the market ignored their unprofitability and cash burn. The tide has since turned, and their stock prices have been crushed. We avoid these companies at all costs.

Our portfolio companies use debt sparingly and are highly profitable. Interest rate increases are a minor annoyance, not an existential threat. They are positioned to use their financial strength to take advantage of their competitors’ misfortunes.

Companies with sustainable competitive advantages or moats often possess pricing power. Their reaction to the current inflationary environment is to raise prices to protect their margins. Many lesser companies can’t pass along price increases without losing business. Quality matters.

In sum, our portfolio companies can handle inflation, higher interest rates, recessions and other negative surprises. They are resilient. The trick is that you have to build your house of bricks before the storm arrives.

Be Prepared

The rising interest rate environment is starting to reveal signs of stress in obscure corners of the market. The UK mini-budget has spooked the British government bond (gilt) market, creating losses for UK pension funds, a selloff in Pound Sterling and forcing a Bank of England intervention. In the US, credit markets are showing signs of disfunction. A few hedge funds have blown up precipitating forced selling. The common thread is usually excessive leverage.

Regardless of the trigger, market opportunities often present themselves suddenly and can disappear just as quickly. As any good Boy Scout will tell you, the key is to be prepared.

With markets having sold off sharply this year, we are now becoming more aggressive. We continually maintain a list of high-quality companies that we would like to own at a certain price. When markets were frothy, we spent our days researching and expanding that list. With the market selloff, several our watchlist companies are now approaching our strike zone (including a UK-based company that we are salivating to buy).

Given the quality of the companies that we own, we are under no pressure to make any sudden moves. But whenever we believe that a better opportunity presents itself, we will react. This process is currently in full swing.

Our commonsense approach to equity investing has not changed since GreensKeeper’s inception. In fact, it never will while our founder is at the helm with his family’s money invested alongside our clients:

- Focus on fundamentals and valuations, not trying to predict market movements.

- Stay invested.

- Invest in quality companies.

- Avoid leverage and be prepared to act when opportunity knocks.

As the Oracle of Omaha himself so aptly put it, value investing is simple, but not easy

Portfolio Update

* As of September 30, 2022. The Value Fund’s holdings are subject

to change and are not recommendations to buy or sell any security

********

Each of our full-time employees has their entire investment portfolio invested at GreensKeeper. In my case, it represents over 70% of my household’s net worth. We invest in the same stocks as our clients and our approach is one of partnership.

If our partnership approach resonates with you, I hope that you give me a call.

Michael P. McCloskey

President, Founder &

Chief Investment Officer