The Golden Rule

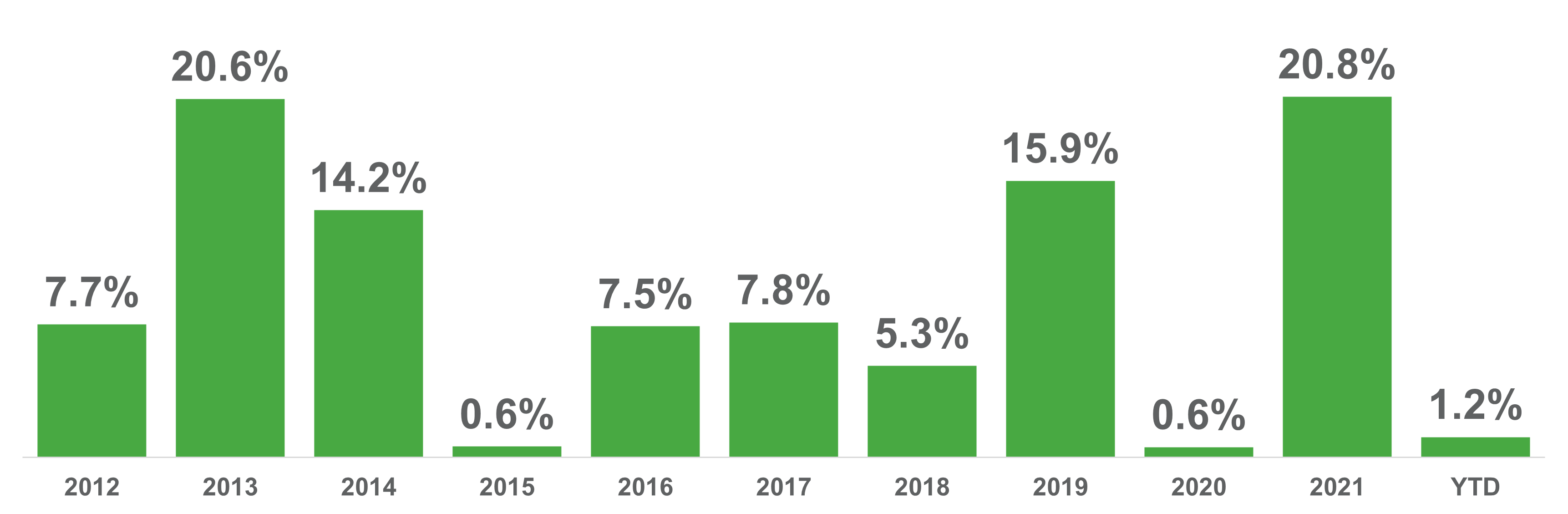

The Value Fund was up +1.2% in Q1. The US dollar lowered our Q1 returns by approximately -1.0%. Markets were downright ugly and despite a rebound in March, most of the major indices ended Q1 in negative territory: DJIA -5.2%, S&P 500 -5.7%, Nasdaq -10.0% and S&P/TSX +3.8%.(1) Investors holding more speculative stocks have seen even steeper declines (and possibly a permanent impairment of their capital).

Even “safe” US Treasuries were down -5.6% for the quarter. We have long shared our view that lending the government our money for a decade in exchange for a 2% yield strikes us as a bad idea.

Longtime readers will know that we aim to grow our investors’ capital while also being mindful of capital preservation and risk management. It is only during times of market stress that investment portfolios are truly put to the test. Fortunately, our house of bricks was up to the challenge.

Given the market environment, the Value Fund is off to an excellent start to the year. We are well-positioned to continue our streak of 10+ consecutive years of delivering positive returns to our clients.

(1) Index returns are for the total return indexes which include dividends and are measured in Canadian dollars, the Value Fund’s reporting currency.

Investing’s Golden Rule

The Golden Rule of “do unto others …” has a less-well-known parallel in the investment world which was coined by the Oracle of Omaha:

Rule #1: Don’t lose money.

Rule #2: Don’t forget Rule #1.

Investing’s Golden Rule incorporates a concept that the human mind struggles to comprehend—power laws and the mathematics of uninterrupted compounding. Albert Einstein was on to something when he called compound interest the eighth wonder of the world.

Investing’s Golden Rule sounds simple enough. But in practice, it is often forgotten, especially when stock markets are bullish and risk taking becomes widespread. Whenever it seems like everyone is making easy money, it is worth reminding yourself that risk is always lurking. What we wrote nine months ago in Scorecard #34 bears repeating:

“Trying to predict and successfully time when the next storm will arrive is not a substitute for sturdy construction. Financial storms tend to arrive with little warning. The key to resilience is to know that they will inevitably come and to prepare in advance.”

Admittedly, we didn’t know that the markets would sell off in early 2022. But as the bull market aged, cautionary signs (sloppy financial analysis, questionable valuations and outright foolishness) were appearing with greater frequency. Shopify (SHOP) worth more than the Royal Bank of Canada (RY)? We begged to differ. The market has since come to agree with us: Shopify is now down over 66% from its peak (and still overvalued in our opinion).

What will the market do for the balance of 2022? No one knows. No one. That includes the so-called experts on CNBC and BNN every day. It won’t surprise you to learn that we spend zero time thinking about the market’s short-term movements.

Instead, we focus on things that can be known. We know that market selloffs happen from time to time even though the catalyst is impossible to predict (e.g., a global pandemic, the war in Ukraine). We also know that over the long term, equity markets rise due to earnings growth. Another unvarying truth: high-quality and undervalued stocks exist in any market environment. They are just harder to find when things are rosy.

There are several other guiding investment principles that we follow, irrespective of market environment. For example, we stay out of bad neighbourhoods.

The war in Ukraine is heartbreaking to watch. It is an unfortunate reality that parts of the world are run by nuclear-armed thugs. The war illustrates why we have always avoided investing in companies domiciled in or otherwise highly exposed to countries like Russia.

We invest our capital in the West. Canada, the United States, Western Europe, Australia and similar countries are all fair game. In the West, we know the rules. We know that our rights as shareholders will be respected and if they are abused, we have recourse to an independent judiciary. How do we define the West? Here’s a great definition that we came across recently:

“The West is a series of institutions and values. The West is not a geographical place. Russia is European, but not Western. Japan is Western, but not European. “Western” means rule of law, democracy, private property, open markets, respect for the individual, diversity, pluralism of opinion, and all the other freedoms that we enjoy, which we sometimes take for granted.” (2)

Stephen Kotkin, Historian

Another guiding principle: we invest in companies that possess sustainable competitive advantages (moats), pricing power and utilize minimal financial leverage. The combination of these attributes position these companies to successfully adapt to inflation, rising interest rates and other adversities that inevitably arise from time to time.

Common sense principles like staying out of bad neighbourhoods and investing in quality companies guide our decision making at GreensKeeper. We think of these principles as tributaries that feed into Investing’s Golden Rule.

Buffett once said that value investing is simple, but not easy. He was right. Fighting our temperament and mood swings between fear and greed is a serious investor’s biggest challenge. Fortunately, GreensKeeper has remained disciplined in its approach and applied these principles since day one. Buy quality companies when they are on sale. Avoid leverage, folly and big mistakes that set you back. It is simple, but not easy.

Portfolio Review

The biggest contributor to the portfolio in Q1 was none other than Berkshire Hathaway (BRK.A/B) +18.0%. With its fortress-like balance sheet ($130 billion of excess cash that grows at $2+ billion a month), Berkshire is a compounder whose intrinsic value increases over time and provides ballast to our portfolio. Over the decades, Warren has been the subject of attacks from critics who label him ‘out of touch’ whenever the stock has lagged temporary price surges in gold, cryptocurrency, etc. This criticism has been useful as it has presented us with the opportunity to purchase the stock cheaply when out of favour. We know that Warren tends to have the last laugh.

(2) Remnick, David, interview of Kotkin, Stephen: “The Weakness of the Despot: An expert on Stalin discusses Putin, Russia, and the West.”, The New Yorker, March 11, 2022.

TVA Group (TVA.B) +18.4% was the second-largest contributor in Q1. We established our position in this Quebec-based small cap just over a year ago (click here for our original investment thesis). The company has delivered decent results and its highest margin segment (film production and audiovisual services) recently announced expansion plans which we welcomed. As a result, the stock is up over 50% since our purchase. Despite the price appreciation, the company still trades at less than five-times Owner Earnings. Still far too cheap in our opinion. As a small cap, the stock is volatile and largely unknown. There will likely be some up and downs. But we suspect that eventually the market will value the stock more in line with our estimate of its intrinsic value in excess of $6.40 per share.

Biotech Vertex Pharmaceuticals (VRTX) +18.8% was our next-largest contributor for the quarter. Our investment thesis for Vertex was very simple. The company’s life-changing cystic fibrosis (CF) therapy continues to gain regulatory approvals and payer reimbursement around the world. This should drive sales growth for the company to the end of the decade. We figured that the company’s CF franchise and its $7 billion of cash (no debt) alone were worth at least $230 per share. While the company’s drug pipeline looked promising, at our average purchase price of $194 per share, we weren’t counting on it.

Since our purchase, Vertex’s sickle cell disease candidate is showing promise. The company also announced positive—albeit early-stage—Phase 2 clinical trial data for its nonopioid pain candidate. So why was the stock so cheap when we were buying?

Biotech Abbvie (ABBV) has been exploring a Phase 2 CF candidate that they hinted may be superior to Vertex’s CF franchise. A viable competitor to Vertex’s CF cash cow and its 97% market share would materially lower our valuation for the company. But anyone who has studied drug development knows that the probability of Phase 2 drugs making it to market are relatively low (<16%). Even if ultimately successful, Abbvie’s market launch would be years away and face an established treatment regimen being used by tens of thousands of patients. In the meantime, Vertex isn’t standing still. They are currently working on an even better CF treatment that would also lower the royalty rates they are paying to a third-party.

Overall, we judged the risk of a major disruption to Vertex’s CF franchise to be low and we position-sized the holding at 3% to mitigate a negative outcome. Abbvie has since delayed the release of its CF Phase 2 data several times. Abbvie’s recent comments also seem to be downplaying the importance of their CF candidate to Abbvie’s overall financial results. Reading between the lines, Abbvie’s CF candidate may have issues.

With Vertex’s drug pipeline starting to show promise and Abbvie less likely to be a threat, the market has taken notice and the stock currently trades at $290. We love asymmetric situations like this. As Mohnish Pabrai would say “heads I win, tails I don’t lose too much”. A big thank you to J. Perez—a fellow VALUEx Klosters attendee—who brought the stock to our attention.

Our biggest detractor for the quarter—by a wide margin—was Meta Platforms / Facebook (FB) -33.9%. The company’s Q4 results were good but its revenue guidance for the current quarter disappointing and the stock sold off accordingly. We have spent a lot of time recently thinking about our investment in the company.

Facebook’s core advertising business is facing headwinds. Apple’s iOS privacy changes have made it harder for Facebook to track users, thus making its ad targeting less effective. We believe that Facebook has a strategy to overcome much of this challenge in the near term. In addition, Apple’s privacy changes hurt all social media companies and Facebook remains best-positioned to deliver attractive return on investments (ROIs) to advertisers relative to their other options outside of search. Long-term, we believe that Facebook’s core business is healthy and will remain a cash flow machine.

That said, the company’s capital allocation decisions leave much to be desired. Share repurchases are being instituted without consideration of the price paid. More concerningly, Zuckerberg’s vision of building a Metaverse is burning about $10 billion a year and growing. Given the health of the core business, Facebook can certainly afford to finance this venture. Considering his track record, we have to give Zuckerberg the benefit of the doubt when it comes to his vision of the platform of the future. However, we are wary of major technology shifts. Given the current stock price we added modestly to our position as we view the risk/reward attractive at current levels. But given the risks, we are monitoring the situation closely as it evolves.

* As of Mar. 31, 2022. The Value Fund’s holdings are subject

to change and are not recommendations to buy or sell any security.

The Value Fund finished Q1 with an 11% net cash position and we are actively searching for attractive places to put it to work.

Firm Update

We are excited to welcome Ivey HBA students Michael Van Loon and Amir Yazdani to the firm’s research team in May. A summer of stock picking is my idea of a good time. Their bios and those of the rest of our team can be found here.

********

In late 2021 we celebrated GreensKeeper’s 10-year anniversary. Starting with a very modest $3 million of assets under management (AUM) and a vision of the future, our growth has continued unabated. With the addition of separately managed accounts (SMAs) a few years ago to compliment the Value Fund, GreensKeeper’s total assets under management (AUM) are approaching $90 million and we are always looking for new clients.

Each of our employees has their entire investment portfolio invested at GreensKeeper. In my case, it represents over 70% of my household’s net worth. We invest in the same stocks as our clients and our approach is one of partnership.

If our partnership approach resonates with you, or someone you know could use some help with their investments, please give me a call.

Michael P. McCloskey

President, Founder &

Chief Investment Officer