Reversals of Fortune

The Value Fund finished the year -4.5%. The US dollar strengthened against most major currencies including the Canadian dollar and boosted our returns by approximately 5% for the year.

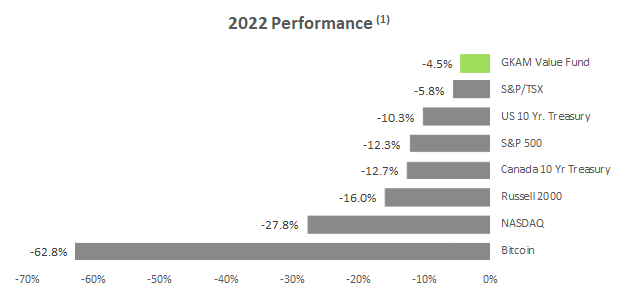

We beat our benchmarks for the year: S&P500 -12.3%, Nasdaq -27.8% and S&P/TSX -5.8% with the US stock market experiencing its fifth-largest loss since the Great Depression.(1) Many portfolios comprised of more speculative investments saw drawdowns of greater than -50%. Even “safe” government 10-year bonds suffered from rising interest rates and delivered double-digit losses for the year. There was nowhere to hide.

Like Rip Van Winkle, inflation—long dormant in the West—awoke from its multi-decade slumber. Interest rates rose in response and after years of loose money which lured many to throw caution to the wind, investors relearned a painful lesson: risk is always lurking.

(1) Index returns are for the total return indexes which include dividends and are measured in Canadian dollars, the Value Fund’s reporting currency.

Value Fund Calendar Year Returns

We stuck to our knitting by avoiding crypto, speculative investments and resisted the fear of missing out (FOMO). As a result, our portfolios were well-positioned for this welcome return to normalcy. As we have often stated, profitability, cash flow and valuations eventually matter.

Given the overall market environment in 2022, the Value Fund delivered on its mission of growing our clients’ wealth while prudently managing risk.

Portfolio Review

The biggest contributor to the portfolio in 2022 was our investment in Merck (MRK) which was up +45% for the year. We first invested in Merck at the beginning of the pandemic in March 2020 along with our investment in Pfizer (PFE). Our investment thesis was straightforward: both stocks were attractively priced at low-double-digit earnings multiples, they offered 3-4% dividend yields, had healthy balance sheets and we thought that one of these companies might just save the world from COVID-19.

Pfizer hit the jackpot with its COVID mRNA vaccine, and we exited that stock in 2021 after it traded above our estimate of its intrinsic value. Merck was not as successful with its COVID regimen, and the stock languished. But Merck’s business continued to thrive due in large part to its blockbuster Keytruda cancer immunotherapy which is generating $20 billion a year in revenue and still growing at 20%. With the market pullback in 2022, investors suddenly started paying attention to Merck’s prodigious free cash flow and the stock rerated. In addition to a bucketful of dividends from these two drug giants, we also received shares in two spinoffs—Viatris (VTRS) and Organon (OGN)—which we also monetized.

Merck and Pfizer are steady and “boring” businesses that fall in and out of favour from time to time. They aren’t compounders meant to be held forever. They were opportunistic purchases that the market offers us occasionally and we are more than happy to take advantage by trading in and out of them.

Our second-largest contributor to our performance in 2022 was biotech Vertex Pharmaceuticals (VRTX) +32%. The company’s life-changing cystic fibrosis (CF) therapies continue to gain regulatory approvals and payer reimbursement globally. When we first purchased the stock in Q3 2021, the market estimated that Vertex’s CF sales would grow healthily and peak at $7.7 billion in 2025 (see table below). In 2022, Vertex’s CF sales are already $8.9 billion and still growing. Just as impressive, the company earns 88% gross margins on that revenue.

Source: Bloomberg Intelligence Research, Aug. 2021.

Vertex has $9.7 billion of cash, no debt, and a promising pipeline of new treatments in development. We had no view on the company’s chances of success with its pipeline when we bought the stock. We just figured that Vertex’s core CF franchise, and its growing cash pile alone was worth significantly more than the company’s market cap. In other words, the core business was being undervalued and we got the pipeline for free. The market has since come to agree with our view of the stock.

Our next-largest contributor to the portfolio for the year was Berkshire Hathaway (BRK.A/B) +4%. There is no better place to be in a market storm than safely ensconced in the financial fortress Warren has built. As we have written about at length, our holding in Berkshire Hathaway is a core position. It should continue to grow at high-single-digits for decades and provides useful ballast to the portfolio.

Finally, our defense giants—Lockheed Martin (LMT) +37% and General Dynamics (GD) +19%—were large contributors to our performance in 2022. Both stocks were purchased shortly after the 2020 US presidential election. With Democrats taking over the White House and both chambers of Congress, markets worried that defense budgets would come under pressure. We had no idea that 14 months later Russia would invade the rest of Ukraine. But we did know that the world is a dangerous place and that these defense contractors make some of the world’s essential and most sophisticated weaponry. We also knew that the stocks were cheap based on their historical trading multiples.

There is a common theme running through our winners from 2022. Each of these stocks was purchased when cheap and unloved. There was no profound prediction of the Ukrainian invasion, a cure for COVID, or any other heroic assumption underpinning our investment theses.

As Yogi Berra so eloquently put it, “It’s tough to make predictions, especially about the future”. Bearing this in mind, we try and keep things simple. Invest in quality businesses that should deliver decent returns based on conservative assumptions. Look for situations with upside optionality that comes for free and avoid stocks that require everything to go right to deliver a satisfactory result. Pay attention to cash flows and avoid companies that are highly leveraged. Value investing is simple, but not easy.

We weren’t perfect in our stock picking last year and Meta/Facebook (META) -64% was by far our worst performer. Meta’s core ad business is performing adequately, despite a tough advertising market and challenges created by TikTok and Apple’s ATT privacy changes. But after evaluating management’s reckless spending plans for 2023, we fully exited the stock in October. Once we lose faith in management, the stewards of our capital, we will invest it elsewhere.

Zuckerberg is all in on the metaverse and we believe that he is rich enough that he cares more about his legacy than his fellow shareholders. His metaverse bet may yet pan out. But we fear that it will not and destroy far too much shareholder value in the interim. Given his voting control of the company, the board is unlikely to rein him in.

We still love Meta’s core business. We got that part of our analysis right and our purchase of the stock was justified. But our continued trust in management after their pivot to the metaverse was a mistake and we should have exited the stock sooner.

* As of Dec. 31, 2022. The Value Fund’s holdings are subject

to change and are not recommendations to buy or sell any security.

Overall, 2022 was a good year for the Value Fund. We beat the major markets and in a sea of red ink, we managed to walk away with our portfolios largely unscathed. The Value Fund finished the year with a 13% net cash position and unrealized gains on its equity investments of approximately $14 million on a $43 million portfolio.

Additional portfolio disclosures including performance statistics can be found on the pages immediately following this letter. Once MNP LLP completes their audit of the Value Fund’s Financial Statements in March, we will provide clients with a more detailed snapshot of the entire portfolio at year end.

Portfolio Look Through

Back by popular demand, we reproduced the table first introduced in Scorecard #34 – Bedrock which analyses the Value Fund’s holdings quantitively and compares them to the constituents of the S&P500 Index.

Source: Greenskeeper Asset Management/Bloomberg/S&P Captial IQ/Fundsmith LLP. Return on Equity, Gross Margin, Operating Margin, Cash Conversion and Free Cash Flow Yield are the weighted mean of the underlying companies invested in by the Greenskeeper Value Fund and the mean for the S&P 500 Index. BRK metrics are calculated based on operating earnings. The S&P 500 Index figures exclude financial stocks except for ROE which includes all sectors. Interest coverage figures are median and exclude financial stocks. Ratios are based on last reported fiscal year accounts as at the respective dates and as defined by S&P Capital IQ. Cash Conversion compares Free Cash Flow with Net Income. FCF Yield for the S&P500 uses the period-end median.

This look-through analysis demonstrates that once again our Value Fund “company” is …

Above-average in quality:

- Returns on Equity are higher than the broader market. As a result, our “company” generates more cash for each dollar of equity capital required to operate and grow the business.

- Gross margins are higher than the market average. We own businesses with pricing power that can charge more for their goods and services than the typical business due to their moats (brand, network effects, switching costs, etc.). This will prove handy should inflation persist.

- Operating Margins are significantly higher than the market average. Our companies usually benefit from scale and efficiency.

- Cash conversion is another tell of earnings quality. Our companies typically generate free cash flow that exceeds their accounting net income (currently about $1.18 for each $1.00 of accounting income versus $0.88 for the broader market).

More Conservatively Financed:- Whereas the broader market has operating earnings (EBIT) of about 10x their underlying interest expense, our companies cover their interest obligations by over 17x. They use debt sparingly and have the capacity to handle rising interest rates.

-

- As of year-end, the Value Fund holdings were delivering a free cash flow yield of 5.9% based on prevailing market prices. This compares with the broader market at 3.4%. At market prices, we are paying less for each dollar of free cash flow than the market overall.

- It is also worth pointing out that many of our portfolio holdings have appreciated materially in value since purchase and the yield at the time of purchase was even higher.

- Even more impressive is the fact that five of our portfolio companies (BRK.A/B, CHKP, CSCO, GOOG and VRTX) have no net debt.Cheaper than the Market:

Superior business economics, lower financial leverage, and undervalued relative to the market. That’s the bedrock that our portfolios are built upon. The resiliency of our portfolio companies served us well in 2022 and should again whenever the next market storm arrives.

Getting Wealthy vs. Staying Wealthy

There are a million ways to get wealthy… but there’s only one way to stay wealthy: some combination of frugality and paranoia”.

Morgan Housel, The Psychology of Money

The quote above is insightful and Housel’s accessible and entertaining book highly recommended. To accumulate wealth, you need to have the discipline to spend less than you earn and then skillfully invest the difference. Most people with money understand that winning formula. But the author’s insight regarding paranoia is the one we find more interesting.

Far too many people who have accumulated wealth have then made poor decisions that caused it to disappear. Excessive leverage. Speculative investments. Vastly increased annual expenditures. Hubris. A combination of these factors is often at the root of major reversals of fortune. Elon Musk may well succeed at Twitter… or he may end up vaporizing $44 billion. Time will tell.

As the Oracle of Omaha remarked, “never risk what you have and need for what you don’t have and don’t need”. That sentence is worth rereading and thinking about.

Compounding wealth successfully requires a combination of prudent investments, reasonable diversification, and a strong dose of humility. The future is unpredictable and strange things happen from time to time (global pandemics and wars come to mind). We believe that the term “margin of safely” coined by Benjamin Graham has a broader meaning than just buying undervalued stocks. To us, it also means building in a buffer for life’s unpleasant surprises.

A company may save a few dollars by sole sourcing a key component, but not if its lone supplier fails. Planning to arrive five minutes before a job interview? A traffic jam can send your career on a totally different path. There is a reason that Charlie Munger had a lifelong habit of showing up to meetings at least 30 minutes early with a newspaper under his arm to keep him company. Wise people develop good habits that create slack. Happy 99th Birthday Charlie! Your wit and wisdom are true gifts to the world.

Photo credit: GreensKeeper (Daily Journal 2018 Annual Meeting)

Photo credit: GreensKeeper (Daily Journal 2018 Annual Meeting)More germane to investing, when interest rates are incredibly low and unlikely to remain so, using higher rates to discount cash flows when calculating a company’s intrinsic value is called for. Something that we have been doing for years. It also means accepting singles and doubles when that is what the market is offering, not swinging for the fences. Growing and preserving wealth requires that you minimize big mistakes that set you back and interrupt compounding.

In almost any situation, building in extra cushion puts you in a position of strength and able to suffer adversity. It takes discipline. But if you had the discipline to accumulate wealth, why not continue that mindset once achieved? There is little downside to doing so. Your future self will thank you.

A Small Favour

Well into our second decade of operations, GreensKeeper continues to thrive. We have recently made several technology investments which will add to our client reporting capabilities. Our research team will expand in a few months with the full-time addition of Michael Van Loon and our traditional summer student program.

With these additional investments, we are positioned to take on additional clients. While most of our clients are based in Canada, we also have added a US custodian to service our growing client base south of the border.

Our goal as a firm has never been to hit a certain level of assets under management. Our goal remains to deliver attractive returns to our clients while prudently managing risk. GreensKeeper’s growth is a natural byproduct of delivering on that mission.

Every one of our employees has their entire investment portfolio invested at GreensKeeper. In my case, it represents over 70% of my household’s net worth. We invest in the same stocks as our clients and our approach is one of partnership. If that resonates with you or someone you know, we would be grateful if you spread the word about GreensKeeper and gave us a call.

Michael P. McCloskey

President, Founder &

Chief Investment Officer