Decennium

The Value Fund finished the year +20.8% (net). A weakening US dollar lowered our returns by approximately -0.8% for the year. Stock markets ended the year near record highs: DJIA +20.1%, Nasdaq +21.4%, S&P/TSX +25.1%, S&P 500 +27.9%.(1)

The past year was GreensKeeper’s tenth-consecutive year of positive returns. Granted, the market environment for equities has been largely favourable. However, valuations remain stretched, and with the Federal Reserve entering a tightening cycle, some of the high-flying stocks of the past few years are now showing signs of stress. We remain steadfast in our approach of owning quality and avoiding speculative stocks that are trading at irrational valuations. We want to earn attractive returns on our capital without taking on major risk.

History teaches that in the long run, valuations matter. Given the quality of our portfolio holdings and our value investing approach, we are well-positioned for a more challenging market environment.

(1) Index returns are for the total return indexes which include dividends and are measured in Canadian dollars, the Value Fund’s reporting currency.

Portfolio Review

The biggest contributor to the portfolio in 2021 was our investment in Alphabet (GOOG/GOOGL) which was up +65% for the year. Despite its immense size, Alphabet’s core business (Search, YouTube, and Cloud) grew revenues 40%+ last year. Add in operating leverage and the company’s core earnings more than doubled to about $111 per share by our calculations.

Google’s AdWords platform continues to benefit from tailwinds stemming from the secular shift to digital advertising. The Google search engine is a common verb and their dominant market share in search, browsers (Chrome), and mobile operating systems (Android) is a testament to the quality of the company’s competitive advantages. Software engineers want to work on the world’s most challenging and innovative projects and get paid well for doing so. Given Alphabet’s leadership in these areas and expansion into driverless cars (Waymo) and Other Bets, the company attracts the best and the brightest.

With growth expected to continue in the 20% range, we believe Alphabet’s core earnings plus the company’s cash alone are worth more than the stock’s current trading price. The Other Bets division currently loses money and some of its projects will certainly fail. But overall, we believe that the division’s portfolio of projects will lead to decent returns on the investments they are making.

Capital allocation continues to improve as Alphabet has been increasing its share buybacks, repurchasing $45 billion of its shares over the past year. Despite this massive expenditure, Alphabet’s net cash position increased over this period to $128 billion due to the company’s prodigious cash generation. Alphabet is currently our second-largest position and one that we hope to own for many years to come.

“When you find an investment with the potential to compound over a long period, one of the hardest things is to be patient and maintain your position as long as doing so is warranted based on the prospective return and risk.”

Howard Marks, Oaktree Capital

Our second-largest contributor for the year was none other than Berkshire Hathaway (BRK.A/BRK.B) +30%. A diversified enterprise with a rock-solid balance sheet, the company spins off some $30 billion of free cash flow a year (and growing). Berkshire should continue to compound in value for decades to come. We view our investment in Berkshire as providing a solid foundation for the portfolio. It remains our largest position.

Another major contributor for the year was our investment in Pfizer (PFE) +60% which we sold in November. We purchased Pfizer along with Merck (MRK) in March 2020 at the outset of the global pandemic. Both stocks offered modest valuations, decent dividend yields, and we figured that one of them might just save the world. Pfizer hit the jackpot with its mRNA vaccine, and we recently decided to take profits as we believe the stock is fully valued and unlikely to compound at an attractive rate.

Merck’s stock was down -6.3% for the year and one of our laggards, but we continue to like the name. The stock is cheap with cancer blockbuster Keytruda generating over $18 billion a year in revenue and growing 20% a year via label expansion. A major criticism of Merck is that the company is too reliant on Keytruda (37% of sales). A fair point. However, Keytruda remains patent protected until 2028 and with the company’s solid balance sheet and multiple drug candidates in the pipeline, Merck has plenty of time to diversify. If they do, the stock should earn a rerating by the market. In the meantime, we get paid a 3.4% dividend yield while waiting for a shift in sentiment to materialize.

As a bonus, we received shares of spinoff companies from both Pfizer (Viatris (VTRS)) and Merck (Organon (OGN)) via stock dividends. We sold Organon in 2021 and will likely sell our holding in Viatris when it is opportunistic to do so.

Rounding out our top contributors for the year were American Express (AXP) +35%, Anthem (ANTM) +44% and Cisco Systems (CSCO) +42%. We have written about these investments previously and don’t have anything to add at the moment.

Our worst-performing stock for the year was cybersecurity provider Check Point Software (CHKP) –12%. Cybersecurity is an industry with long-term tailwinds and the shift to working from home increases the importance of network security. The company generates 43% operating margins, holds $4 billion in cash (no debt) and earns very high returns on capital. So why has the stock underperformed? The short answer is growth. Check Point has been losing market share to competitors that are growing their revenues faster. But many of these competitors are unprofitable and yet the market assigns very high valuations to them. If Check Point can accelerate growth, even slightly, our bet is that the stock will earn a rerating. At current prices, the stock delivers a 9% free cash flow yield. Far too cheap if that growth materializes.

Other laggards for the year included Merck (discussed above) and Visa (V) -1%. Visa is one of the best businesses we have ever come across. Gross and operating margins of 97% and 66% respectively. Low capital requirements leading to obscene cash flows which they use to purchase emerging technologies and return to shareholders via dividends and share repurchases.

But Visa has not been immune to Covid with consumer spending on travel still well-below pre-pandemic levels. We believe that travel will return in the near term. The other risk facing Visa is the risk of technological disruption from fintech newcomers. After a deep dive on the sector (see our full report), we concluded that Visa’s wide moat remains intact and the company very difficult to disrupt. Accordingly, we added to our position in November making it a top-five holding. The full list of our top-ten holdings is in the table that follows.

* As of Dec. 31, 2021. The Value Fund’s holdings are subject

to change and are not recommendations to buy or sell any security.

Overall, 2021 was a good year for the Value Fund and investors in general. The portfolio returned +20.8% (net) while mitigating risk by holding high-quality companies and avoiding overvalued and speculative stocks. This positioning should serve us well whenever the tide turns.

The Value Fund finished the year with an 8% net cash position and unrealized gains on its equity investments of approximately $16 million on a $44 million portfolio. Our average holding period for stocks over the past decade has been five years (average annual portfolio turnover of 20%). As a result, we have minimized transaction costs and deferred the realization of capital gains for our clients.

Additional portfolio disclosures including performance statistics can be found on the pages immediately following this letter. Once KPMG completes its audit of the Value Fund’s Financial Statements in March, we will provide clients with a more detailed snapshot of the entire portfolio at year end.

Risk Revisited

Until very recently, growth has been outperforming value. Fast revenue growth has been rewarded, and unprofitability ignored. Call us old school; we prefer investing in profitable companies that generate free cash flow. Our investment process at GreensKeeper doesn’t just consider what to purchase—we are also very mindful of what to avoid. Our view is that while a select few of the fast growers may eventually become the next Amazon (AMZN), most are more likely to disappoint and see their lofty valuations crushed.

For example, Tesla (TSLA) was the fifth-largest contributor to the S&P 500 Index’s return last year (representing 2.7% of the index’s return). Tesla currently trades at 15x forward revenue and 120x earnings. Tesla may be an amazing company and at the leading edge when it comes to EV technology, but we aren’t willing to bet that it is worth more than the nine next-largest automakers combined. For perspective, those other carmakers sell about 34.5 million cars a year versus Tesla’s 0.9 million.

Source: Brandon Knoblauch @brandude87; Company filings. Data as of January 16, 2022.

Even great companies can be terrible investments if purchased at an irrational price. We commend Elon Musk for what he is building and for changing the world. We truly do. But capitalism’s competitive destruction means that competition is coming. We would also note that Elon recently sold 10% of his stake in Tesla for $16.4 billion to pay income taxes. We bear him no grudge as he deserves to enjoy the fruits of his labour. But we wouldn’t touch Tesla’s stock at these levels with a ten-foot pole.

We don’t mean to pick on Tesla as there is plenty of folly in the market these days. Trump announces a SPAC and suddenly a blank-check company is worth billions. Cryptocurrencies are being valued in the trillions. Perhaps cryptocurrencies are here to stay. But we would note that Dogecoin was invented as a joke and now sports a market value of $54 billion. Stablecoin Tether was recently fined $41 million by the SEC for misstating its reserves. The entire industry is swarming with promoters, bad actors, and criminals that take advantage of cryptocurrencies’ anonymity. These are meme assets being driven by speculators who invest more with their hearts than their heads.

We don’t know what the catalyst will be that triggers a reckoning for the speculative excesses of the current market. It could be as mundane as rising interest rates. The triggering event is often something completely unexpected. We also don’t know when it will happen. But we do know that for as long as markets have existed, investor sentiment will change. Euphoria will become concern and ultimately panic. Human nature remains immutable. We continue to be mindful of these risks and manage them by using common sense: by putting our money to work in quality companies trading at reasonable valuations.

Portfolio “Look Through”

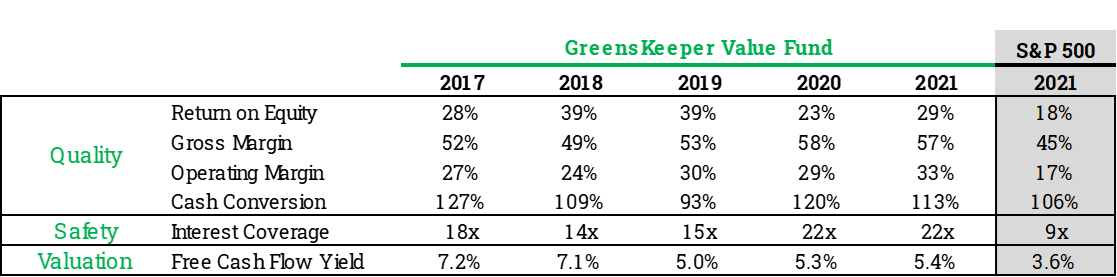

Quantifying the quality of our portfolio via our look-through analysis in Scorecard #34 – Bedrock proved very popular with clients. Below is the updated information for the full year.

Instead of presenting the Value Fund as a mutual fund, this analysis aggregates the underlying holdings at different periods of time and presents the portfolio as if it were a company (called a “look-through” analysis). We then did the same with the S&P 500 Index.

Source: Greenskeeper Asset Management / Bloomberg / S&P Capital IQ. Return on Equity, Gross Margin, Operating Margin, Cash Conversion and Free Cash Flow Yield are the weighted mean of the underlying companies invested in by the Greenskeeper Value Fund and the mean for the S&P 500 Index. The S&P 500 Index figures exclude financial stocks except for ROE which includes all sectors. Interest coverage figures are median and exclude financial stocks. Ratios are based on last reported fiscal year accounts as at the respective dates and as defined by S&P Capital IQ. Cash Conversion compares Free Cash Flow with Net Income. Free Cash Flow Yield for the S&P 500 uses the period-end median.

Our house of bricks continues to demonstrate its quality construction. As the numbers above attest, the Value Fund “company” is above average in quality:

- Returns on Equity are materially higher than the broader market. As a result, our “company” generates more cash for each dollar of equity capital required to operate and grow the business. That cash can then be redeployed in the business at favourable rates or returned to shareholders.

- Gross margins are comfortably higher than the market average. We own businesses with pricing power that can charge more for their goods and services than the typical business due to their moats (brand, network effects, switching costs, etc.). This will prove handy should inflation persist.

- Operating Margins are also significantly higher than the market average. Our companies usually benefit from scale and efficiency.

- Cash conversion is another tell of quality. Our companies typically generate free cash flow that exceeds their accounting net income (currently about $1.13 for each $1.00 of accounting income versus $1.06 for the broader market).Sophisticated investors recognize that Return on Equity can be increased merely by adding financial leverage (and risk). But that is not the case with the Value Fund’s holdings. Our companies generate higher ROEs while employing lower financial leverage than the market. Whereas the broader market has operating earnings (EBIT) of about 9x their underlying interest expense, our companies currently cover their interest obligations by over 22x and use debt sparingly. In other words, our companies are more conservatively financed. Should interest rates rise as expected, they have the capacity to handle it. Even more impressive is the fact that five of our portfolio companies (CHKP, CSCO, FB, GOOG and VRTX) hold $234 billion in cash and have no net debt.

Given the quantitatively superior business quality and lower financial leverage, one would expect that our portfolio of companies would trade at a premium to the market. They do not. As of year-end 2021, the Value Fund holdings were delivering a free cash flow yield of 5.4% based on prevailing market prices.(2) This compares with the broader market at 3.6%. At market prices, we are paying less for each dollar of free cash flow than the market overall. It is also worth pointing out that many of our portfolio holdings have appreciated materially in value since purchase and the yield at the time of purchase was even higher.

Superior business economics, lower financial leverage, and undervalued relative to the market. That’s the bedrock that our portfolios are built upon. The resiliency of our portfolio companies should serve us well whenever the next market storm arrives.

The Next Decade

The past year marked GreensKeeper’s 10th anniversary and our assets under management grew once again at a healthy pace. The Value Fund is now available for purchase on the RBC platform, and we expect to expand distribution of the fund to other dealers in the coming years. James continues to broaden our firm’s awareness and Michelle does a great job of looking after our clients and helping me with regulatory compliance. We are continuing our summer analyst program again this year.

On a more personal note, I started the firm to create a vehicle for friends and family who were interested in having me invest their capital alongside my own. It has been an amazing decade of learning and growth. GreensKeeper has allowed me to follow my passion for stock picking and lifelong learning. I am truly looking forward to growing the firm and our investments for decades to come.

GreensKeeper’s client growth has been largely due to referrals from our existing clients. Thank you for your continued support and the trust that you have placed in us.

Each of our employees has their entire investment portfolio invested at GreensKeeper. In my case, it represents over 70% of my household’s net worth. We invest in the same stocks as our clients and our approach is one of partnership. If that resonates with you and you are looking for a new money manager, we hope that you give us a call.

Michael P. McCloskey

President, Founder &

Chief Investment Officer