The Bear

The Value Fund was down -12.3% in Q1 and the major market indices declined even further: TSX -20.9%, DJIA(CAD) -16.2%, S&P500(CAD) -12.8%. Along with COVID-19, the bear market has officially arrived. It seems that COVID-19 pulled a bear market out of hibernation and humanity took its place.

Given our significant U.S. stock holdings, the weakening of the Canadian dollar (the Value Fund’s reporting currency) provided some shelter. In times of market panic, investors tend to flock to the greenback. A more detailed explanation of our view on currency hedging (and our bias for not doing so) can be found here.

COVID-19 pulled a bear market out of hibernation and humanity took its place.

A Useful Mental Framework

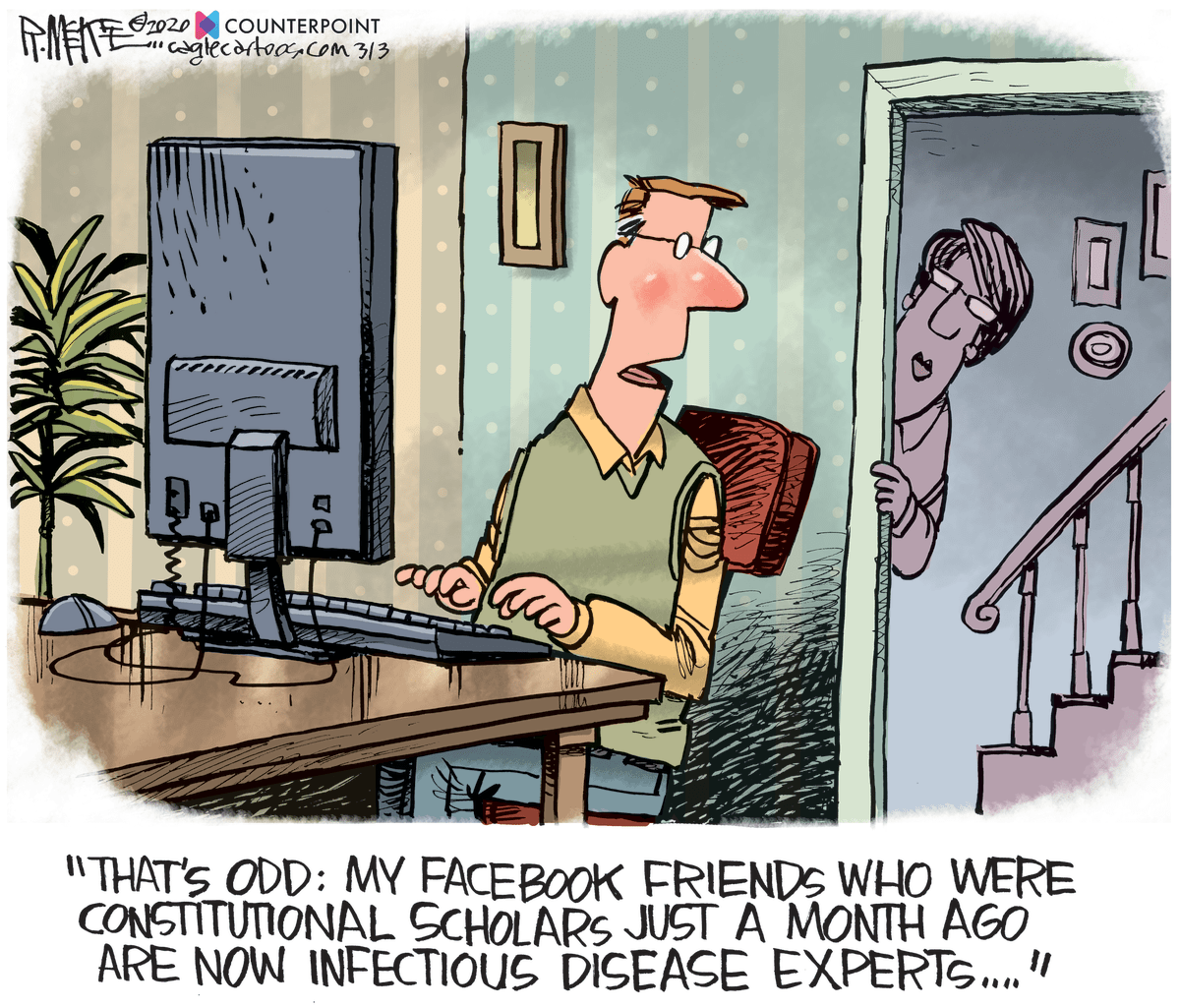

Before diving into the portfolio, let’s briefly address the current pandemic. We decided to share the cartoon above for several reasons. First, we can all use a little levity to help get us through this trying time. COVID-19 is taking a tragic toll on the vulnerable, disrupting economies, creating unemployment and heightening anxieties. This is a difficult and disorienting time. But the cartoon also contains an important message. The source of (mis)information on this novel pathogen should be scrutinized by each of us. Our preference is to listen to the experts, namely the medical and scientific community. We also recognize that there is much that they do not yet know about this new pathogen.

With that said, we are not epidemiologists, we are capital allocators. Accordingly, we will refrain from adding to the cacophony of voices shouting for attention on the best way forward.

But we will share with you a source of timeless wisdom that we find very helpful at present. The ancient Stoics lived through pandemics and many other hardships in their own time. What advice would they offer us at present? Try to focus on the things within our control, namely our response to the events we are faced with.(1)

At GreensKeeper, that means keeping our employees and their families safe via self-isolation, spending our time analyzing companies and valuations and monitoring the progress of the pandemic and its impact on our investment portfolio.

Despite the dreadful headlines, we remain very optimistic that things will improve. We are all fortunate to be living in this modern age. Earlier plagues caused tens of millions of deaths, were poorly understood and medical treatment ranged from the primitive to the non-existent. Below is a photo of an actual 16th century leather plague mask worn by doctors at the time. Personal protective equipment (PPE) and the rest of science has come a long way since then.

German Museum of Medical History

(1) For those interested in learning more about Stoicism, this link is to a presentation given by our founder on the topic at an investment conference in January 2020. Suggested books for further reading on Stoicism can also be found on our bookshelf webpage.

The entire world is focused on finding solutions to the coronavirus pandemic The best scientific minds are hard at work and will not lack for resources. Modern medicine will find a solution. Governments are stepping in to provide financial support to those most affected as they should. For those reasons and a few others, we remain rationally optimistic.(2)

The Value Fund Portfolio

Here’s how we are thinking about our investment portfolio in the current environment.

The current disruption to certain businesses is real and has likely reduced earnings for many companies for 2020. As a result, market valuations should be lower. But the overall change to the intrinsic value of many companies is likely to modest. For example, we are confident that Visa’s earnings will be materially higher five and ten years from now.

It is important to remember that stocks represent ownership interests in real businesses. The value of those businesses typically changes slowly as it is based on the lifetime of the future cash flows that they will provide to their owners (shareholders). Over 95% of the value of most companies has nothing to do with their earnings this year.

At the same time, we need to acknowledge that the coronavirus’ impact on companies will vary. Some businesses will see limited impact (e.g. pharmaceuticals). A few companies may even experience a short-term benefit (e.g. supermarkets and food producers). But in general, most businesses are being harmed due to forced closures and reduced customer demand.

Companies with highly-leveraged balance sheets and small businesses without reserves to see them through the current lockdown may never recover. We are on heightened alert to ensure that these businesses never find their way into our portfolio. Owning them often leads to a permanent loss of capital when an unexpected shock arrives.

We continue to upgrade the portfolio opportunistically by selling fully-valued positions and replacing them with stocks that are cheaper. For example, we recently trimmed our holding in Novo Nordisk (NVO) and added two other high-quality pharmaceutical companies that offered what we believe are more compelling valuations.

We are also prepared to change our minds if our thinking changes regarding the economic impacts of the current pandemic on a stock or industry. For example, we recently sold our entire position in Booking Holdings (BKNG) at a loss. Air travel is a coincident indicator for the hotel business which is where Booking Holdings makes virtually all its profit. Airline volumes are down 90% at present and we suspect that things will only gradually get better over the remainder of the year.

Booking Holdings is an amazing company. Its balance sheet and ability to trim variable costs like advertising should see it through to better times. In fact, its services will be even more valuable to hotels looking to drive occupancy once travel recommences. But at the current stock price we believe that investors are over-optimistic about how quickly travel demand will return and at what level.

(2) We highly recommend The Rational Optimist : How Prosperity Evolves by Matt Ridley.

Glenn Fogel — Booking Holding’s CEO — was recently interviewed on CNBC and hinted that the company may reduce future business travel given how effective the shift to working remotely has been. When a travel company makes that statement, we take it at face value. While we believe that leisure travel will eventually get back to and then surpass prior levels, business travel is likely to be structurally lower for several years due to changing habits and budget tightening.

We would be happy to own BKNG stock again at a lower price. But at current levels we believe that expectations are still far too high. Coming to terms with the pandemic is very difficult for people to absorb psychologically. There are various degrees of denial taking place as people try to comprehend the extent of the impact. That is understandable given the scale of this tragedy. We are doing our best to accept that the world has changed, and that it will take an uncertain amount of time to resolve. This is a time for investors to be coldly rational and aware of their own cognitive biases.

The good news is that we managed to avoid any direct investments in the airline industry. Berkshire Hathaway owns several of them and appears to be selling shares in them at present. Fortunately, it is a small part of their equity portfolio. We never agreed with Buffett’s change of heart regarding the airlines which he long avoided. We simply never liked the business given its highly cyclical and capital-intensive nature.

Since year end, the major changes to the portfolio have been an increased exposure to companies in the Healthcare, Pharmaceutical and Consumer Products sectors, a reduction of our cash position and a reduced exposure to the Technology and Energy sectors.

The situation is fluid and we have been very active with the portfolio. Over the past 60 days our trade volumes have exceeded what we typically do during an average year. In times of market panic, investment opportunities often present themselves. If the markets go lower, we may get additional chances to sell what is cheap in order to buy cheaper. Each day we simply react to the opportunity set in front of us.

We can’t recall the source but distinctly remember someone describing value investing consisting of long periods of inactivity mixed with decisive aggression when opportunity knocks. It is starting to knock.

Success [in investing] means being very patient,

but aggressive when it’s time.

Charlie Munger

Berkshire Hathaway 2004 Annual Meeting

While we will remain nimble and opportunistic in this market environment, rest assured that we will never compromise on quality. Unless a company has a balance sheet and business model that can carry it through this storm, even if it lasts for several years, we aren’t interested. At any price.

Market Outlook

We acknowledge that things look bleak at present. But as discussed earlier, we are confident that they will get better in time. Advances in medicine, communication and human knowledge will see us through this. The biggest uncertainties in our minds relate to the timing, path, and economic impact of the way forward.

Short-term, extensive testing and monitoring combined with the discovery of effective therapeutics should allow the economy to restart in some limited form. Longer-term, vaccines and/or herd immunity may be the ultimate solution. Trying to predict these variables with certainty isn’t possible (at least for us).

Instead, we simply accept that the economy will be severely disrupted for at least a year and unemployment far, far too high. We then try and analyze the short-term impact on companies, their projected earnings a few years out and compare that with the current valuations in the market.

We have no view on the short-term direction of the equity markets or whether they have bottomed. We also firmly believe that no one else has any idea where the market will be at the end of the month or the end of the year for that matter. No one.

We think that investors are better off simply ignoring the parade of “experts” on CNBC and BNN Bloomberg TV despite their strong opinions on the topic. We view it as entertainment, not investible advice. For those requiring proof to support our thesis, we have an excellent example. The chart below shows the weekly US initial unemployment claims numbers.

The prior record of peak unemployment claims in any week was 665,000 which took place during the Great Recession (2009). Over the past two weeks, the new claims numbers were an unimaginable 3,307,000 and 6,648,000 respectively. Both figures were also materially higher than the consensus view. In other words, they were worse than the market expected. Yet on the days that those figures were released, the S&P500 Index ended up +6.2% and +2.3% respectively. Go figure.

American Express (AXP) is one of our portfolio holdings and we are confident that they will survive the current challenge and go on to deliver growing dividends and earnings in the future. Yet the market discounted its share price by over 50% within the span of a month. Only three days later the stock was 39% higher. This is no small cap penny stock – AXP is a Dow component member with a market capitalization of approximately $75 billion.

While markets are usually efficient, they can do very strange things during times of stress. During these periods, they are often driven by emotion and fund flows. Value investing founder Benjamin Graham coined an apt metaphor: “… in the short run, the market is a voting machine but in the long run, it is a weighing machine”.(3) The fact that Mr. Market changes his mind about the value of businesses minute by minute is only relevant if you are influenced by and act on it by basing your investment decisions on his current mood. Remember that he is there to serve you, not to guide you.(4)

Severe market declines can also bring about forced selling. Investors that use leverage (levered funds and margined investors) need to quickly post additional collateral when the value of their portfolios decline. If they are unable to do so, they are forced to liquidate their positions at whatever price the market has on offer at the time. A parallel situation is Norway’s $1 trillion sovereign wealth fund that owns approximately 1.3% of all global equities. There are credible reports emerging that the fund is liquidating a portion of its portfolio to fund government withdrawals necessitated by the sharp oil price collapse.

All of the foregoing reemphasizes the need for equity investors to possess a long-term investment horizon. Those requiring short-term liquidity pay a very dear price when markets tank.

At GreensKeeper, we do not use any leverage in the portfolio and will never receive a margin call or be forced to sell at an inopportune time.

In addition, the companies that we own have solid balance sheets and are not at the mercy of their lenders. On the contrary – many of them have little to no debt, excess cash and are aggressive purchasers of their own shares (e.g. Visa (V), S&P Global (SPGI), Facebook (FB), Alphabet (GOOG), Novo Nordisk (NVO)). Lower stock prices are a good thing for these companies as it enables them to retire even more shares for each dollar spent thereby boosting future earnings per share.

(3) Securities Analysis by Benjamin Graham and David Dodd.

(4) The Intelligent Investor by Benjamin Graham (Chapter 8)

We also recognize that valuations were lofty going into the current crash. Many stocks are nowhere near as cheap today as they were in March 2009 during the lows of the Great Recession.

There are also many low-quality companies with questionable business models still trading at what we believe are eye-popping valuations. For example, there are scores of North-American-listed companies that didn’t earn a profit last year, yet they continue to trade at valuations north of $10 billion. We suspect that things won’t be easier for them in the current environment. These are land mines and we plan to continue to steer far clear of them.

The current market environment is the time for investors to be highly selective and pick individual, high-quality stocks from the bottom up. In addition, we should demand a wide margin of safety given the uncertain economic outlook. In other words, we are looking for things that are dirt cheap. We are also mindful of the fact that while the current selloff has been unique in terms of how quickly the market has declined, many prior corrections were deeper. We could yet retest the March lows. No one knows.

Instead of trying to predict the impossible, we focus on what we can control. We know that the companies that we own can weather this storm, even if it lasts for several years. We also strongly suspect that owning high-quality equities will lead to better returns versus lending our money to the Canadian or U.S. government for 10 years in exchange for the “risk free” 0.6% annual return currently on offer.

Holders of government bonds are insulated from volatility as the principal is guaranteed by the government. But they pay a very high price given that inflation is almost certain to erode their purchasing power over the next decade. Our path will certainly be bumpier, but likely to leave us much farther ahead over the long term.

No one knows where the markets will finish the month or the year for that matter. But we do know that buying quality companies when they are on sale has historically been a recipe for success. The reason is that declining stock prices actually lower the risk of owning an asset whereas price rises increase risk. Read that last sentence again and think about it. Once you understand that truism, you will look at investing in a new light.

The best time to buy stocks is right after they have been repriced via a broad market crash. Unfortunately, our reptilian brains struggle to overcome the sense of danger that makes buying at the best time so difficult. While short-term market moves are impossible to predict, we have a pretty good idea of what equities tend to deliver over the long term.

(5) Chart source: https://www.sensiblefinancial.com/recent-stock-market-performance-in-context/

Our Firm

As an essential service, GreensKeeper has continued to operate without interruption. In fact, our employees started working remotely before the government mandate. We value our employees and will continue to prioritize their safety. Our business continuity plan and Microsoft cloud network infrastructure have made the changes to our daily routines a non-event. Our business was built to last.

Q1 was a rough start to the year. Equity markets do this from time to time and our memories of prior crashes are helping us to navigate the current one.

The quality and liquidity of the equities that we own allow us to make changes to the portfolio quickly and with virtually no market impact. Several clients reached out to us recently and added to the funds that we manage for them. They recognize that widespread market panic can create attractive long-term opportunities. We are appreciative of the quality of our client base and the fact that they share our long-term investment philosophy.

From our perspective, being in self-isolation has its benefits. We are working at a furious pace and laser-focused on stock analysis and positioning the portfolio for the next leg up. We are constantly updating our watch list of companies that we would like to own and the price that we are prepared to pay for them in the current environment. We are also adding a university student to the research team for the summer to help with the load. There is lots to do.

From our GreensKeeper family to yours, stay safe!

Michael P. McCloskey

President, Founder &

Chief Investment Officer